C. JUSTIFICATION OF THE AMOUNT OF EUR 3,000

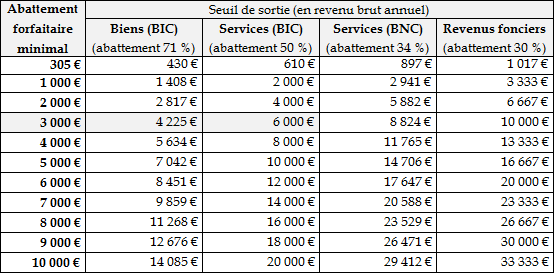

The EUR 3,000 threshold must be regarded, in particular, in the light of the exit thresholdsthat follow it for each activity category.

Possible exemption thresholds and exit

thresholds

for taxpayers under the micro-tax

system

The exemption thresholdis the level where the tax-free allowance is equal to the gross annual income. It is currently set at EUR 305, the minimum level of tax-free allowances of the micro-tax system.

The exit thresholdis the level of annual gross income where the proportional tax-free allowance under ordinary law of the micro-tax system becomes more favourable than the minimum fixed tax-free allowance. These thresholds are valid if the gross income received via platforms relates entirely to only one of the categories. In the case of mixed income, the actual exit threshold depends on the share of each category of income.

Source: Senate Finance

The EUR 3,000 annual threshold is equal to EUR 250 of gross income per month, or a little less than EUR 60 of gross income per week.

Beyond the principle of a threshold, establishing its level necessarily implies some uncertainty , given the new nature of the proposed measure and the very patchy knowledge that the public authorities have of income derived from collaborative platforms. Given its general nature and its application to the gross proceeds, this threshold also implies some simplification that the Working Group assumes responsibility for and considers to be necessary.

This threshold must be a simple criterion, clear and generally applicable, whose level must be set so as to exempt occasional and sideline income earned through collaborative economy platforms, while remaining neutral once the activity provides significant income which may otherwise create a distortion of competition with regard to classicprofessionals. It must moreover be sufficiently incentivising to encourage automatic reporting.

In this respect, the EUR 3,000 level appears to meet these criteria:

- i t is equivalent to a sixth of the monthly gross SMIC (minimum salary) (EUR 1,480 in 2017 60 ( * ) ), or to half of the RSA (Income supplement scheme) (EUR 353 in 2017) : much lower than the income that could be gained from an employed full-time or even part-time activity, it equates to a non-negligible complement of income for a person benefiting from low resources. In this regard, and in order to take account of the increase in the cost of living, it could be envisaged, eventually, to index the threshold in line with the consumer price index or to the SMIC itself, or the “ Plafond annuel de la Sécurité sociale ” 61 ( * ) (PASS), by analogy with the affiliation thresholds discussed above ;

- from a sector-specific point of view, it is equal, for example, to half the average annual cost for a private individual of a city car clocking up 15,000 kilometres 62 ( * ) ;

- it seems to be able to benefit users of platforms typically offering income of an occasional nature . For example, the average annual income of a private individual is EUR 350 on Stootie , EUR 700 on Drivy and Ouicar , EUR 400 on Leboncoin (excluding vehicles and real estate), etc.;

- the simulations carried out by the Working Group on the basis of precise figures communicated by the platforms confirm coverage of the large majority of users of most of the platforms, without however exempting the most active users and service providers;

- finally, the level of EUR 3,000 appears to be in line with the choices made by other European countries (see insert) . In Belgium, in particular, the Minister of the Digital Agenda, Alexander De Croo, has estimated that approximately 90% of users of collaborative platforms in Belgium received income lower than the EUR 5,100 threshold, and would therefore be taxed at the reduced rate of 10%, instead of 33% (see below).

|

Comparisons with other European initiatives United Kingdom : the threshold of 2 x 1,000 pounds is slightly less advantageous, but it is an additional tax-free allowance and not accompanied by automatic reporting, which ultimately makes it more permissive. Belgium : the EUR 5,100 threshold is higher, but lower income is subject to a set tax of 10%. Italy : the proposed EUR 10,000 exemption threshold is higher, but lower income is subject to a set tax of 10%. These initiatives are set out in detail in the third part of this report. |

The EUR 3,000 level, of course, may be changed depending on new elements. At this stage, what is important is to set out the principle.

* 60 On the basis of the legal working time i.e. 35 hours per week or 151.67 hours per month.

* 61 The EUR 3,000 threshold is equal to approximately 13% of the PASS, set at EUR 39,228 in 2017.

* 62 Source: Agency of the environment and energy management (ADEME), Private vehicles sold in France , Official Guide, 2011 edition, page 26.