INTERNATIONAL COMPARISONS: SINGLE THRESHOLD AND AUTOMATIC REPORTING, A CHOICE MADE BY SEVERAL COUNTRIES

The proposals of the Finance Committee Working Group on tax and tax collection in the digital economy are based on a comparison with the initiatives taken or considered by several other countries . To this end, members of the Working Group have visited several countries and some information has been provided by the economy department of the Directorate General of the Treasury.

Although few countries, for the moment, have changed their tax and social contributions rules in order to adapt them to the development of the online platform economy, it seems that the same questions arise everywhere, and the same terms.

With regard to the five countries studied by the Working Group, the United States, Estonia, the United Kingdom, Belgium and Italy it appears that the solutions adopted or envisaged, besides their various arrangements and their own weaknesses, all opt for specific treatment of income derived from online platforms , and more particularly:

- with regard to those countries taxation rules have all opted for the introduction of general thresholds , in place of a theoretical principle of taxation from the first euro and assessment on a case-by-case basis, even if these thresholds are set at various levels with different tax advantages. In this regard, it should be noted that the introduction of general gross proceedsthresholds has not been deemed contrary to the constitutional principles of the two countries concerned, i.e. the United Kingdom, Belgium;

- with regard to reporting procedures, a consensus emerges to give the platform a third-party reporting or even collecting role , at least in the medium or long term. Between thousands or millions of buyers on one side, and thousands or millions of sellers on the other, the platform is in fact the most reliablelink in the chain, if not the only one.

I. THE UNITED STATES: INCOME IS REPORTED TO THE FEDERAL AUTHORITIES AND SOMETIMES TO LOCAL AUTHORITIES

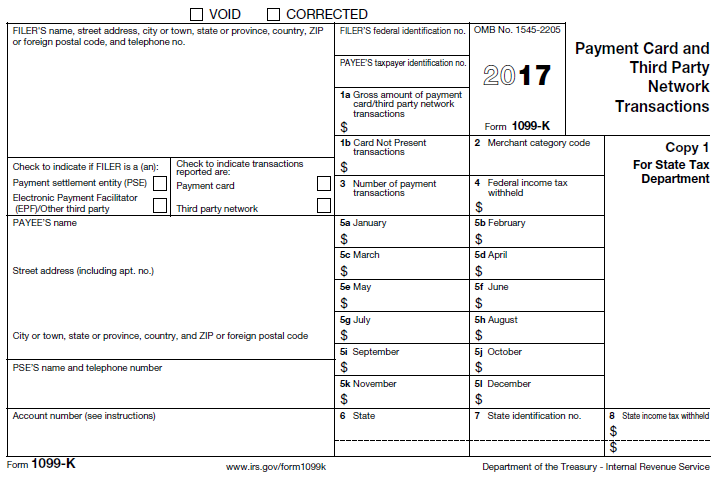

A. FORM 1099-K: QUASI-AUTOMATIC REPORTING, YET WEAKENED BY OVERLY-HIGH THRESHOLDS

1. An obligation for online platforms and payment intermediaries

The United States has a mechanism for reporting all gross income received by a taxpayer via an online platform: Form 1099-K.

To understand this system, one must know that in the United States, private individuals fill their tax return, among other things, on the basis of forms that they receive from the people who have paid income to them. Employees receive a Form W-2 from their employers. Self-employed workers, receive a Form 1099-MISC for their various income 88 ( * ) . They can also receive Form 1099-K which is sent to them by payment intermediaries.

Form 1099-K must be completed by all payment intermediaries 89 ( * ) , a category that covers both the traditional operators of payment cards ( Visa , Mastercard etc.), services like PayPal, and intermediation platforms which act as a trusted third party in the transaction i.e. most platforms of the collaborative economy, whose model is based on levying a fee on the transaction. The form can be completed online.

However, for each beneficiary, Form 1099-K must be completed by the intermediary only if the transactions exceed both the $20,000 per year threshold and the threshold of 200 transactions per year 90 ( * ) .

The intermediary sends a copy of this form to the beneficiary , who uses it to complete his annual tax return minus, where appropriate, expenses incurred for the activity. A copy is also sent to the Internal Revenue Service (IRS) , which thus has elements allowing it to verify the accuracy of the tax returns that it receives and to target tax controls. Form 1099-K is therefore not strictly speaking reporting by a third party , but an element aimed at encouraging voluntary tax compliance , according to the IRS.

By analogy, transposing the Form 1099-K procedure to France would amount to ensuring that the platforms send to the tax authorities, every year, a copy of the annual summary of transactions provided for in Article 242 bis of the General Tax Code (see above).

In San Francisco, members of the Working Group were able to see that platforms such as Uber and Airbnb did indeed fill in Form 1099-K on behalf of their users , like most main platforms, above, of course, the $20,000 and 200 transactions per person thresholds . This is also the case for Upwork , which fills in a different form depending on whether the mission is for temporary work (1099-MISC or 1099-K) or for a classic employment contract (W-2) 91 ( * ) .

2. A system based on overly-high thresholds, and which could be improved

However, this system appears to be very far from working perfectly . Even though the income derived by private individuals from the sharing economy is, as in France, taxable under the conditions of ordinary law, it is often not reported and therefore not taxed.

Confirming the findings of the Working Group, a May 2016 study carried out by Caroline Bruckner, of the American University in Washington DC 92 ( * ) , notes that 61% of users who have received income via an online platform had not received Form 1099-K or 1099-MISC from the platform, and that 69% of them had received no assistance or information on this subject from the platform. Moreover, 43% of them were unaware how much tax they could be liable for , and they therefore had not put any money aside for this purpose. Nevertheless, the IRS states on its website, if you receive income from a sharing economy activity, its generally taxable even if you don't receive a Form 1099-MISC, Form 1099-K or Form W-2 . This is true even if you do it as a side job or just as a part time business and even if you are paid in cash.

During her hearing by the Small Business Committee of the House of Representatives, on 24 May 2016, Caroline Bruckner stated: Notwithstanding the on-demand platform economys unprecedented growth and adoption by more than 86.5 million U.S. adults as consumers and service providers and sellers in just a few short years, the economic activity and growth of these small business owners has largely gone unacknowledged by most government measures for tracking small business activity. () In fact, many of these taxpayers dont necessarily realize they are small business owners or what their tax filing obligations are until tax time or they receive an IRS notice 93 ( * ) .The situation is therefore very similar to that in France.

Three factors appear to explain these failures:

- firstly, although large platforms such as Uber , Airbnb or Upwork play by the rules, this is not always the case of the very many small platforms which, taken together, represent a considerable proportion of the activity. Thus, like in France (see above), Airbnb sends each of its hostsa summary of its annual income and makes a full page informing them of their tax obligations available to them a policy that very many more modest actors do not implement;

- secondly, the minimum thresholds adopted by U.S. tax law appear to be overly-high , given the very dispersed nature of the collaborative economy, where each individual can be his own business, and the generally low amount of income from the gig economy . Thus, a taxpayer earning $19,000 per year, for 190 transactions, will not be subject to reporting to the IRS . It is easy to imagine, moreover, the ease with which an unscrupulous taxpayer could separatehis various income sources into several accounts, in order never to cross the thresholds;

- thirdly, Form 1099-K is not a pre-filled tax return , but a simple item of information for the taxpayer and the tax authorities, which the latter do not necessarily systematically use.

In the light of the American example, the Finance Committee Working Group of the Senate therefore developed its proposals on the basis of the following two observations:

- firstly, a system that is legally an automatic income tax return , and therefore reported on the taxpayers pre-filled tax return (without of course preventing him from correcting it), is preferable to a purely informative system in parallel;

- secondly, reporting from the first euro is preferable to reporting above certain thresholds, especially if they are high, and even if this means that the reported income then benefits from a tax-free allowance or another tax advantage .

* 88 There are a series of 1099forms: 1099-MISC for miscellaneous income, 1099-G for social aid, 1099-DIV for dividends, 1099-INT for interest, etc.

* 89 Source: Internal Income Service (IRS), Instructions for Form 1099-K (2016) , and other information from the www.irs.gov website. For the translations: Senate Finance Committee.

* 90 These minimum thresholds do not apply to card payments, which must be reported in their entirety.

* 91 By default, it is the customers responsibility to determine the legal system applicable. In return for a paid option, determination of this system can be carried out by the platform, which then assumes the related legal risks.

* 92 Caroline Bruckner, The Tax Compliance Challenges of Small Business Operators Driving the On-Demand Platform Economy , Kogod Tax Policy Center , American University in Washington DC , 23 May 2016. See also the article by Michael Cohn, The Sharing Economy doesn't Share Tax Information , Accounting Today, 27 May 2016.

* 93 https://www.irs.gov/businesses/small-businesses-self-employed/sharing-economy-tax-center and https://smallbusiness.house.gov/uploadedfiles/5-24-16_bruckner_testimony_.pdf