II. ESTONIA: A DEAL WITH UBER FOR AUTOMATIC REPORTING OF DRIVERS' INCOME

THE PLATFORM-STATEAND THE PLATFORM: A SELF-EVIDENT, SUCCESSFUL PARTNERSHIP

In October 2015 102 ( * ) , the Estonian Tax and Customs Board (ETCB) and Uber announced that they had concluded an agreement for setting up an electronic system for the automated transmission of data relating to driversincome, on a voluntary ( opt-in ) basis.

This initiative must be understood in the context of the legalisation, introduced in November 2015, of transport services of passengers by private individuals , offered by platforms such as Lyft , Uber and Taxify . These services, if they are performed in return for a fee, were outlawed in France by the ThévenoudAct of 1 October 2014 (see above), as in other European countries.

|

The legalisation of transport services between private individuals in Estonia A competitive market where actors already use mobile applications Estonia, a country of 1.3 million inhabitants, currently has over 4,000 taxis 2,300 of which in Tallinn. Although there is approximately 1 taxi for every 1,158 inhabitants in France, this same ratio is 1 for every 325 in Estonia. Estonian taxi drivers must comply with the same obligations as their French and European counterparts (meter, safety standards). But unlike the French situation, there is no quantitative restriction on the number of taxis and the cost of the licences remains low. Today, approximately 40% of customers in Estonia call a taxi by using a mobile application, the leading one being the Estonian, Chinese-owned, application Taxify . Created in 2013, in sixteen months this application has become market leader in Estonia. Now present in nine countries (Finland, Baltic countries, Belarus, Poland, Czech Republic, Netherlands, Serbia), it has more than 500,000 customers in Europe and a growth rate of 10% to 20% every month. More than 2.2 million bookings were made via this platform in Estonia in 2015. Although 37% of taxi drivers are currently registered on the Taxify application alone, the company explains that it can no longer operate without the contribution of the workforce made up of non-professional drivers . At certain times of the day, in particular between 10 pm and 2 am, demand far outstrips supply. Taxify explains it has over 1,000 drivers who are private individuals in the three Baltic State, working an average of seven hours per week. Although these drivers do not have to comply with the same legal obligations as taxis, the platforms require them to respect a quality charter (no criminal record, proficiency in the Estonian language, a licence held for three years, training in providing the service, vehicle less than ten years old). According to Taxify, the average score assigned by the customers to these non-professional drivers totals 4.88 out of 5. Thus, only 0.5% of these drivers have been blocked by the platform for non-compliance with the quality charter compared to 34% of professional taxis. New legal status and online income tax return The bill on transport services between private individuals aims to adapt the existing legal framework to the development of this new sector. As it stands, it gives drivers who do not carry out this activity as their main job micro-enterprisestatus. In addition, it allows them to fill their income tax return online . () According to Mark Helm, Director of the ETCB, reporting this income will be done on a voluntary basis. Voluntary payment of taxes appears to him to be a key element in regulating these service activities offered by private individuals (more generally than in just the transport sector). In his opinion, Estonian citizens have demonstrated in the past their compliance with tax rules, which would limit the number of controls needed. He eventually proposes to make this income reporting platform developed by Estonia available to all non-professional drivers regardless of their country of residence, with Estonia then taking on the responsibility of passing on the information to each State concerned . Source: Directorate General of the Treasury (Tallinn economic unit) |

The first Member State of the European Union to have legalised fee-paying transport services between private individuals, Estonia is therefore, according to the Directorate General of the Treasury, in the process of developing the most efficient taxation system produced up to now in this field . Thanks to its flexible legal and administrative environment, it has managed in just a few months to create an automatic data exchange system with Uber, which is used to include driversincome in their tax returns .

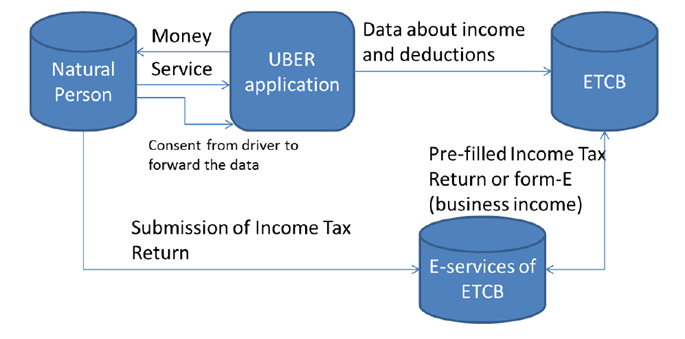

The system is specifically designed for the business models of the collaborative economy : it allows the platforms, which are contact and payment intermediaries, to pass on the relevant data to the tax authorities, as the employers and banks already do , which are then included in the taxpayerspre-filled tax return . Up to now, the system was unable to take into account and therefore, to a certain extent, to tax income from the activity of self-employed workers and private individuals.

The module presented below is therefore intended to be integrated into the national information system of levies and taxes .

|

Operation of the automatic reporting

system

The example of Uber The system is organised as follows: 1) The company, the self-contractor or the natural person earns income through a third party; 2) On a voluntary basis , the customer authorises the third party to send the data about him to the ETCB; 3) The third-party actor sends the data via the budget module provided by the ETCB; 4) The taxpayer can add the additional costs of his activity manually or via integrated partners (banks, insurance companies, etc.) ; 5) The budget module calculates the amounts due of VAT and income tax and creates the final tax returns by taking into account the other sources of income. It also contains other functions : registration in the commercial register and VAT registration. Source: Directorate General of the Treasury (Tallinn economic unit), and Estonian Tax and Customs Board (ETCB) |

After a few monthsdevelopment, the first data transfer was successfully carried out in January 2016 , and the Estonian tax authorities consider the results to be very encouraging.

In the light of this success, Estonia plans to open up the system to all collaborative platforms, perhaps as soon as late 2017 . According to the information available to the Working Group, the ETCB has already initiated discussions with Taxify (main competitor of Uber ), with Postpal (management of the delivery process for e-commerce) and with Autolevi , (car rental between private individuals, like Drivy and Ouicar in France).

* 102 http://www.emta.ee/eng/etcb-and-uber-collaborate-seeking-solutions-development-sharing-economy